JAKARTA - Bank Indonesia (BI) plans to issue Bank Indonesia Securities (SVBI) and Sukuk Valas Bank Indonesia (SUVBI) as pro-market monetary instruments for deepening financial markets.

BI Governor Perry Warjiyo said BI will launch SVBI and SUVBI to deepen financial markets and support efforts to attract portfolio inflows, by optimizing securities assets in foreign currencies owned by Bank Indonesia as underlying.

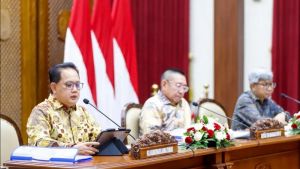

"It is hoped that SVBI and SUVBI can attract foreign capital flows in the portfolio market," Perry said at a press conference on Thursday.

In addition, SVBI will be issued on tenors 1.3.6.9 and 12 months while SUVBI will be issued with a tenor of 1.3.6, months with a T plus 2.

Perry explained, the issuance of SVBI through general bank auctions that are participants in conventional open market operations (OPT) in foreign exchange.

Meanwhile, the issuance of SUVBI through auctions with Islamic commercial banks and Sharia Business Units (UUS) which are participants in OPT Syariah in foreign currency.

SEE ALSO:

Perry added that SVBI and SUVBI can be traded on the secondary market and traded with non-residents

"This is a form of BI's commitment to a more pro-market. So that gradually we launch more pro-market instruments," he explained.

Furthermore, SVBI and SUVBI can be transferred to non-banks, Indonesian people and foreigners.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)