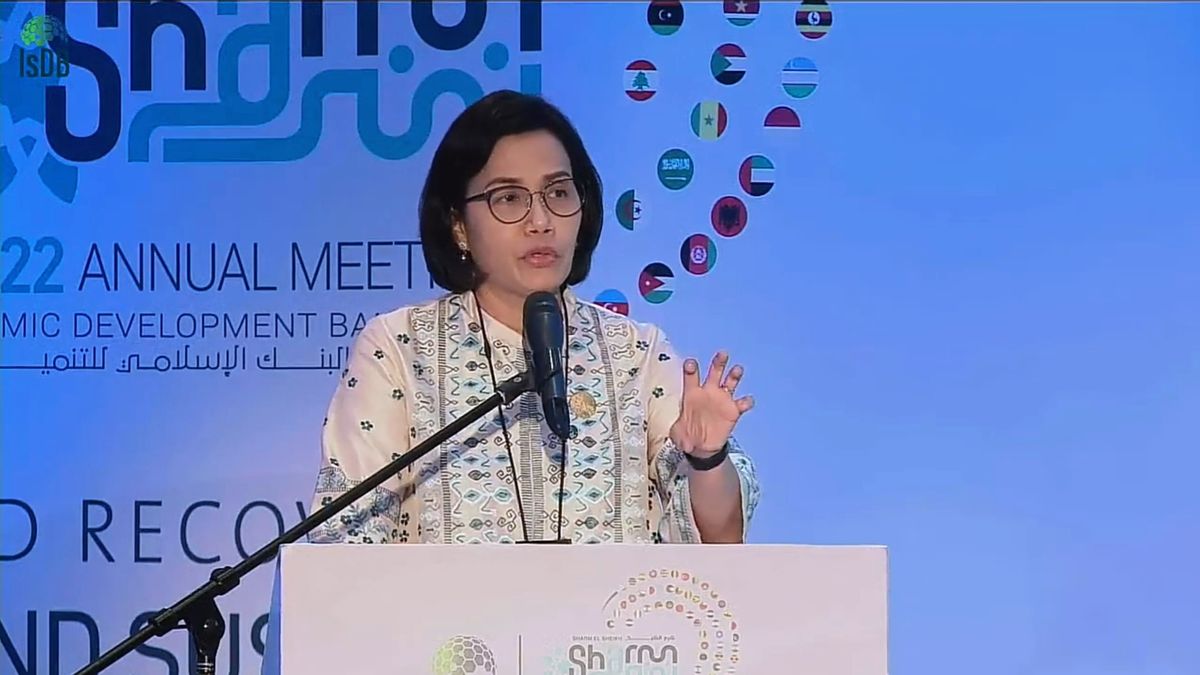

Minister of Finance (Menkeu) Sri Mulyani explained the process of establishing Indonesia's Sovereign Wealth Fund (SWF) in a virtual bilateral meeting with Pakistan's Minister of Finance Muhammad Ishaq Dar.

Minister of Finance Sri Mulyani told the process of establishing the SWF institution as part of financial reform in Indonesia.

"The government is conducting benchmarking related to the legal, structural and governance basis with several SWF institutions that already exist, such as those belonging to the United Arab Emirates," he said as reported by the official website on Thursday, March 9.

According to Minister of Finance Sri Mulyani, the government is recruiting the best candidates to fill executive positions and supervisory boards. He said, the recruitment process involved companies in the field of human resources that have an international reputation.

The government also invited SWF representatives from other countries to conduct interviews directly with selected candidates. All of this is done so that the SWF institutions formed are truly credible and professional," he said.

Minister of Finance Sri Mulyani added that the formation of the SWF was part of reforms through various Omnibus Laws in the era of President Joko Widodo.

"This aims to strengthen the economic foundation as well as provide jobs in Indonesia," he said.

On this occasion, the Minister of Finance of Pakistan appreciated the achievements of the Indonesian economy after successfully passing the pandemic and economic recovery.

"SWF in Indonesia is one of the models that is considered to have developed very rapidly and was appreciated by Sheikh Mohamed bin Zayed Al Nahyan, President of the United Arab Emirates," said Pakistan's Minister of Finance.

For information, the Sovereign Wealth Fund (SWF) is a fund owned by the government to be invested in various instruments with the aim of obtaining returns, gains, or other types of income. The basic funds can come from the APBN, receipts such as oil and gas receipts, or from other legitimate sources of revenue.

With the SWF, it is hoped that there will be no idle and unused state revenue. This acceptance can be invested appropriately and in quality so that useful returns can be obtained. Currently, SWF in Indonesia is managed through the Indonesia Investment Authority (INA).

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)