JAKARTA - The Indonesian Life Insurance Association (AAJI) reported the performance of 58 Life Insurance Companies in the January-December 2022 period. Consistently, the life insurance industry is increasing. As of December 31, 2022, the total life insurance industry is 85.01 million people, this figure is an increase of 30.4 percent when compared to 2021.

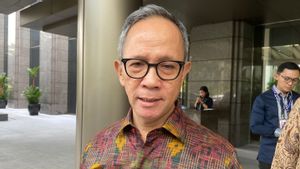

Chairman of the AAJI Management Board, Budi Tampubolon, said that the increase in total responsibility that occurred throughout 2022 was an extraordinary achievement in the midst of unstable economic dynamics. This result gives confidence to the life insurance industry that the public is increasingly aware of the importance of life insurance protection as one of the future financial planning.

The life insurance industry currently protects nearly 29 million people who are individually responsible and more than 56 million people are responsible for this collection. This consistent increase is the provision and responsibility of the industry to prove to the public that the Indonesian life insurance industry is a healthy industry and is able to carry out public trust, "explained Budi, in Jakarta, Tuesday, March 7.

Community trust is the foundation in the development and growth of the life insurance industry. Through the application of the Financial Sector Strengthening and Development Law (UU P2SK) and Circular regarding Insurance Products Related to Investment (PAYDI), it will further strengthen the protection system for insurance policyholders.

The Policy Guarantee Program (PPP) which is currently a priority of the P2SK Law is a shared dream of all insurance industry players. The protection of policyholders is also further strengthened by the enactment of SEOJK No. 5 of 2022 which regulates PAYDI's development and marketing. The existence of the welcoming call process, recording, changes to the terms of waiting period and premium leave as well as an increase in transparency of fund management in PAYDI is a form of commitment to strengthen protection for policyholders and become a stimulus in improving the life insurance industry business, "added Budi.

However, Budi also explained that in line with the adjustments made by the company related to SEOJK PAYDI, AAJI hopes that the Financial Services Authority (OJK) will support this momentum by optimizing the stages of adjusting PAYDI products so that they can be marketed immediately by the company.

Regarding income, until the end of December 2022, the total income of the life insurance industry is still under pressure. It was recorded that the total income of the life insurance industry was IDR 223 trillion, a decrease of 7.5 percent compared to the same period in 2021.

The decline in life insurance industry revenue is largely influenced by the shifting of premium products and payment methods by the community. In general, the premium income of the life insurance industry has decreased, including new business premium income. The existence of growth in total coverage but the delay in premium income indicates that the target market for the life insurance industry is getting wider and can be said that insurance products marketed by the life insurance industry have targeted the middle to low community who want to have insurance protection but with relatively small premium value," said Budi.

Head of Product, Risk Management, GCG AAJI, Fauzi Arfan conveyed that the total claims and benefits paid by the life insurance industry during the period January to December 2022 were recorded at IDR 174.28 trillion.

The life insurance industry is a liquid industry. This is evidenced by more than 12 million customers having received their rights from the industry for the benefits of their life insurance policies. Based on the types of claims paid, individual health claims are one of the components with a very high increase, where year on year it rose 46.1 percent. This is evidence in the midst of the issue of inflation in the world of health. This industry consistently supports the National Health Insurance (JKN) program run by the Government," explained Fauzi.

Based on data until December 2022, the life insurance industry posted total assets of IDR 611.22 trillion. This result increased by 1.5 percent when compared to total assets in December 2021. 87.9 percent of total assets were total investments, which up to that period recorded a value of IDR 537.45 trillion.

Chairman of the Financial, Capital, Investment and Tax AAJI, Simon Imanto stated that the total investment in the life insurance industry was recorded to have increased by 1.3 percent when compared to the value recorded in December 2021. In general, the investment placement of the life insurance industry is still dominated by Shares with a total placement of 29.5 percent of the total investment as a whole or equivalent to Rp158.51 trillion.

Even though it is still dominated by investment in stock instruments, judging from the growth of the life insurance industry, it is currently more focused on placing long-term investments such as in the State Securities (SBN) instrument. As of December 2022, the total investment placement in SBN instruments was recorded at IDR 143.57 trillion or contributed 26.7 percent of the total investment. In addition, the continued increase in investment placement in SBN instruments is an industrial commitment to always contribute to the national economy through financial support for the Government's long-term development," Simon concluded.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)