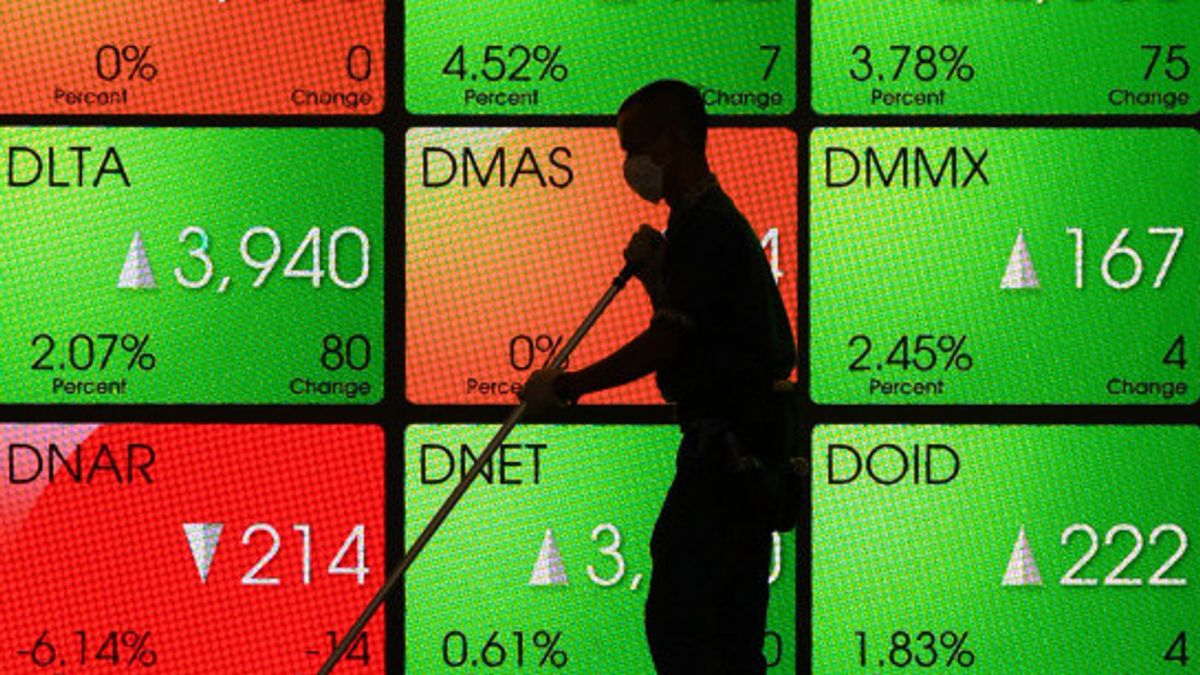

JAKARTA - The movement of the Composite Stock Price Index (JCI) is predicted to strengthen in trading on Tuesday, February 28, after yesterday's narrow correction of 1.79 points or 0.03 percent to 6,854.77

Phintraco Sekuritas in his research said that the closing of the JCI yesterday formed a spinning bottom pattern. In line with this movement, the narrowing of the negative slope in MACD continues.

"JCI is expected to move sideways in the range of 6,820-6,880 for some time to come forward and potentially rebound to 6,870 on Tuesday," explained Phintraco Sekuritas.

From domestic economic data, the market anticipates inflation data in February 2023 which is estimated to have increased slightly by 5.28 percent from the realization in January 2023.

Banking stocks, including BBNI, BMRI, BBCA and BBRI, are expected to continue rebounding on Tuesday's trading. Technically, the four formed gold cross in the oversold area on the Stochastic RSI indicator.

In addition, the latest regulatory plan from the government that supports the ease of licensing for organizing arts and sports events in Indonesia encourages expectations of increasing public spending.

Thus, the distribution of credit in the banking sector is expected to increase. Expectations to increase public spending also encourage the strengthening of a number of property stocks, such as PWON, CTRA, SMRA and BSDE.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)