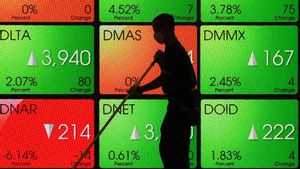

JAKARTA - The Composite Stock Price Index (JCI) will turn around to the green zone this week. The increase was after the JCI went hot and cold last week.

Equity Analyst of PT Indo Premier Sekuritas Rifqi Satria Dinandra estimates that the increase was supported by a number of sentiments, including the Indonesian trade balance, Bank Indonesia (BI) interest rates, and US inflation data.

"The JCI was hot and cold last week under pressure from the technology and property sector or real estate. This weakening technology was affected by global exchanges whose technology sectors also weakened. The property and real estate sectors had profit-taking because a few weeks ago it had strengthened," Rifqi said quoting Antara, Monday, February 13.

He explained that the consensus estimates that Indonesia's trade balance will return to a surplus of US$3.26 billion in January 2023, from the previous recorded surplus of US$3.89 billion in December 2022.

Meanwhile, consensus estimates that BI will withhold its benchmark interest rate at this February meeting, after raising it by 25 basis points to a level of 5.75 percent in January 2023.

Furthermore, regarding US inflation to be announced on February 14 local time, he said that so far the consensus estimates inflation will fall again to 6.2 percent from the previous 6.5 percent.

"US inflation is one of the data that investors are waiting for to predict the policy direction of the Fed," said Rifqi.

On this occasion, he explained that in general, stocks last week were supported by reports of Indonesia's economic growth in the fourth quarter of 2022.

Indonesia's Gross Domestic Product (GDP) recorded a growth of 5.01 percent year on year (yoy) supported by the transportation and warehousing sector, accommodation, as well as food and beverages due to increased community mobility and foreign tourist visits.

"In annual GDP Indonesia grew 5.31 percent, supported by spending and household consumption which grew 4.93 percent yoy and became the largest source of growth of 2.61 percent," said Rifqi.

In addition, he continued, positive sentiment last week also came from foreign exchange reserves which rose to USD 139.4 billion in January 2022, from USD 137.2 billion in December 2022.

He explained that this increase was caused by the issuance of global government bonds as well as tax and service revenues.

He also recommended buying for trading until February 17, 2023 in stocks, including the BBRI financial sector (Support: IDR 4,780, resistance: IDR 4,980), BBCA (Support: IDR 8,650, resistance: IDR 9,050), BMRI (Support: IDR 10,150, resistance: IDR 10,650), and BBNI (Support: IDR 9,400, resistance: IDR 9,800).

The non-primary consumer goods sector is RALS (Support: IDR 680, resistance: IDR 720), and the raw goods sector namely SMGR (Support: IDR 7,500, resistance: IDR 8,125), INTP (Support: IDR 11,225, resistance: IDR 12,000) and MDKA (Support: IDR 4,600, resistance: IDR 4,860).

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)