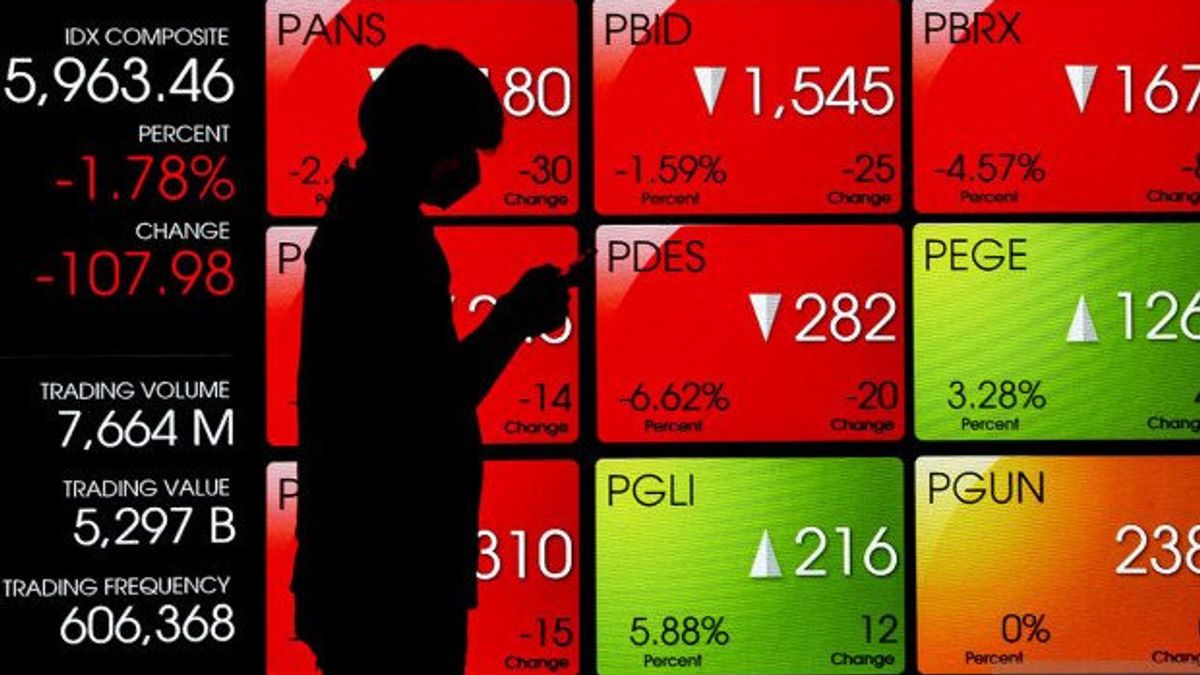

JAKARTA - The movement of the Composite Stock Price Index (JCI) is predicted to consolidate on Tuesday, December 27. Phintraco Sekuritas said the JCI will move at resistance at 6,900, pivot 6,800, support 6,720.

"JCI is estimated to tend to consolidate in the range of 6,800-6,900 today. Technically, RSI's Stochastic is still overbought area and MACD tends to move sideways," wrote Phintraco Sekuritas in his research.

From external, Phintraco Sekuritas added, the EU's plan to block access to the vegetable oil market follows a new law that prevents the sale of commodities related to deforestation in the European Union. These regulations will apply to soybeans, beef, palm oil, wood, cocoa and coffee as well as several derivative products.

"This has the potential to further suppress the movement of CPO prices, which have weakened since last week," added Phintraco Sekuritas.

From within the country, Phintraco Sekuritas said, especially the capital market, strong signal window dressing has not been seen. Transaction volume which tends to fall throughout last week and in trading last Monday indicates the potential for consolidation in the last week of December 2022.

"Pay attention to the stocks in the LQ45 index that have the potential to rebound, such as BBCA, BBRI, BBNI, BMRI, TOWR and ERAA. Also pay attention to the continued rebound from BTPS today," explained Phintraco Sekuritas.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)