YOGYAKARTA Different checking accounts and account mutations are two things that customers often confuse. Both of them both display a history of savings. However, there are some differences in each service.

Accounts for newspapers and account mutations can both be accessed by banking account owners. In general, both of them function to find out the history of financial activity in the account. However, both of them have differences from understanding to benefit. Some differences between bank accounts and account mutations are as follows.

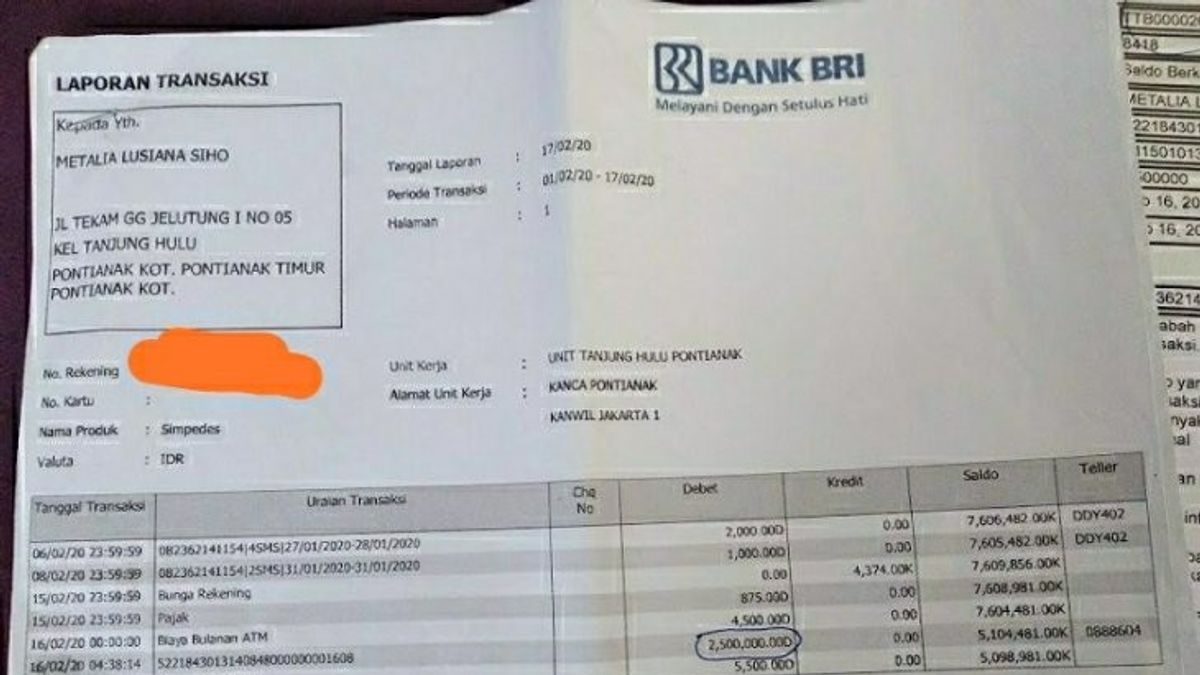

A bank statement is a summary of financial transactions that occur in a comprehensive account, either on a personal account or business entity account.

While account mutation is a transaction history that occurs in a bank account. Account mutation is one of the sources of incoming and outgoing money transactions from the account.

One of the other differences between bank statements and account mutations is the information provided. In a bank account, the information provided is more detailed with a longer period of time. The information presented in the bank account of the flow of debt and credit, includes the proceeds of transfers both in and out. In addition, there is also information on the date to the time of the transaction carried out.

Meanwhile, in account mutations, the information presented is relatively less than in bank statements, even the time period provided is only 7 to 14 days ago.

How to print a bank account and account mutation is quite different. In a bank account, customers must formally submit it to the bank. In several banks the application for a bank for a bank account can be done online.

Meanwhile, how to get an account mutation is very easy. Customers can get it through ATMs, Mobile Banking, or through the official banking website. The process of issuing account mutations is also easy and fast.

Untuk mendapatkan rekening koran, nasabah akan dikenakan biaya administrasi dengan besaran yang berbeda-beda antara bank. Misalnya, untuk mendapatkan rekening koran di BCA di dikenakan biaya sekitar Rp25.500/lembar, biaya rekening tahunan BRI sekitar Rp25.000/lembar dengan data yang ditbilatkan per lembarnya adalah 12 bulan ke belakang. Berbeda lagi pada Bank Mandiri yang dikenakan biaya sebesar Rp25.500/lembar dengan rekaman transaksi 3 bulan terakhir. Biaya rekening koran sendiri akan disetorkan ke bank dengan besa berbeda-beda tergan kebijakan perbankan.

As for getting account mutations, customers are not charged a penny, aka free, so customers can print account mutations at any time.

Usually the bank account is used as one of the requirements for submitting a visa. The bank statement will be used as proof of strengthening that the visa applicant has sufficient financial power so that he will not lack money while abroad.

Accounts of newspapers have greater legal force than account mutations. Usually bank statements are used to prove the existence of transactions that have been carried out for a certain period of time. On the other hand, account mutations have limitations on information and the duration of transaction recordings.

Those are some different checking accounts and account mutations. Visit VOI.ID to get other interesting information.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)