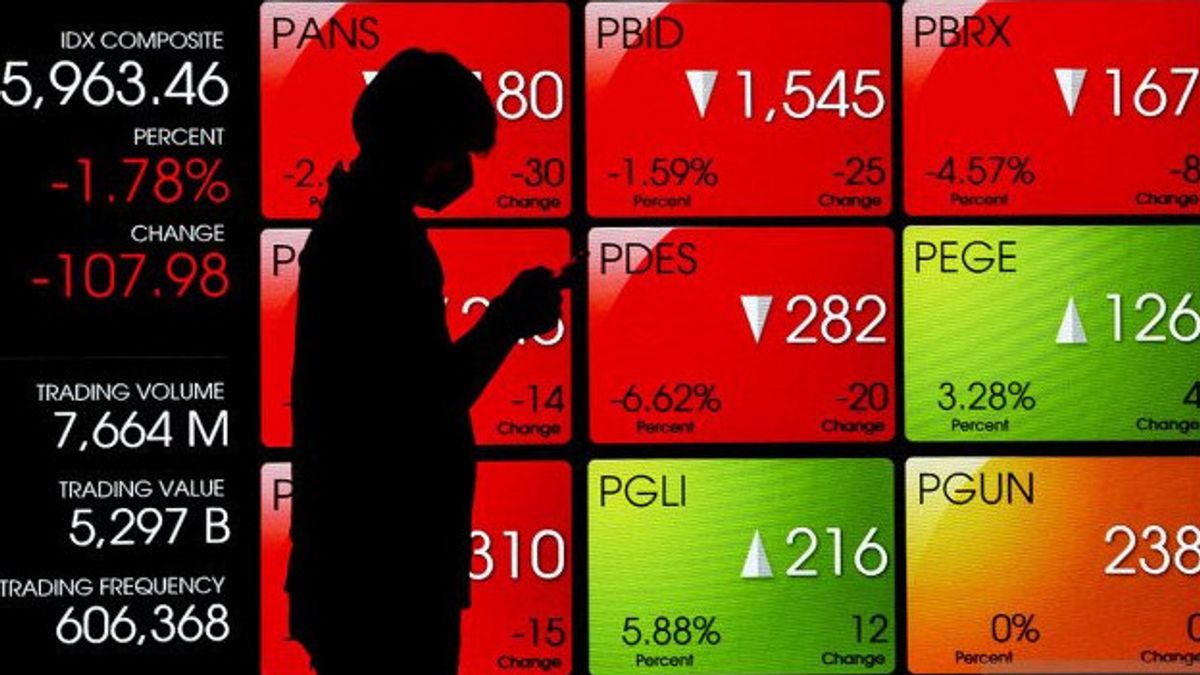

JAKARTA - The movement of the Jakarta Composite Index (IHSG) this week will be overshadowed by a number of economic data releases. The JCI closed down 0.64 percent or fell 43.77 points to a level of 6,813.63 at the end of last week.

Director of Equator Swarna Capital Hans Kwee believes that market players are waiting and observing the Fed's decision to raise interest rates. Atlanta Federal Reserve President Raphael Bostic said the central bank should stick with slow and steady rate hikes, a quarter point (25bps) for now, to avoid an economic downturn.

"The statement eased market worries earlier, when positive US unemployment data made investors worried about the possibility of a faster and bigger increase in interest rates," explained Hans in his research.

Further, the released economic data points to a steady demand for services, by the purchasing managers' index (PMI) from the Institute for Supply Management and S&P Global. This means that activity in the sector continues to grow even when input prices fall.

Meanwhile, across Europe, inflation data turned out to be hotter than expected. Flash projections for the eurozone showed headline inflation falling from 8.6 percent to 8.5 percent, but this was above the consensus forecast for 8.2 percent.

"On the other hand, solid economic data out of China supports expectations that Beijing will set an ambitious 2023 growth target at this weekend's annual parliamentary meeting," said Hans.

In the midst of global economic turmoil, Indonesia's manufacturing sector has consistently expanded for 18 months in a row and was recorded at a level of 51.2 in February 2023. The resilience of the national manufacturing sector was driven by domestic demand which remained expansive. The supply chain is also considered to have improved in terms of shorter delivery times due to more efficient logistics performance.

"At the end of the week, fears of a more aggressive increase in the Fed's interest rate are starting to subside. Some positive data has the potential to push the JCI higher with support at 6,781-6,688 and resistance at 6,889-6,961," said Hans.

관련 항목:

Meanwhile, Phintraco Sekuritas, in its research, explained that market players will also seek the release of China's Trade Balance data, both exports and imports for the January-February 2023 period.

China's trade balance is expected to rise to 80.9 billion US dollars. Meanwhile, exports are expected to slow down to 10 percent from the previous 9.9 percent and imports are expected to slow down to 5.3 percent from 7.5 percent.

Technically, JCI has the potential to form a death cross at the Stochastic RSI, in line with the widening of the MACD negative slope. This indicates the potential for further weakness. JCI is expected to test the support level of 6,780 on Monday.

For trading this Monday, Phintraco Sekuritas chose SMGR, INTP, LSIP, TLKM and EXCL shares to be the top picks.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)