JAKARTA Bitcoin (BTC) prices have decreased in the past week, although on-chain data shows something encouraging for (miners) miners. For your information, on-chain data is data recorded in blockchain that reflects activity and trends in crypto networks.

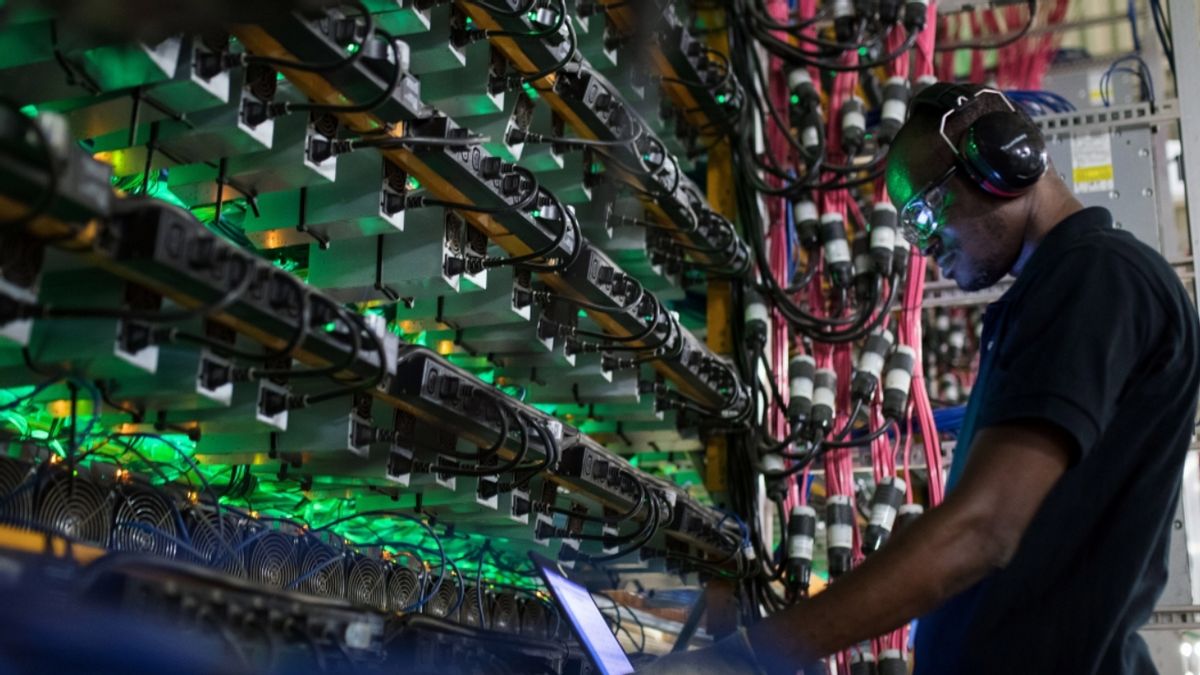

The level of difficulty in mining processes, which measures how competitive mining activity is, has suddenly risen to its highest level in history. Despite previous declines, recent two-week auto-tuning brought the level of Bitcoin mining difficulty to jump more than 6%, setting a new record high.

Data from the BTC.com monitoring platform reveals that this is the sixth largest increase in mining difficulty levels during 2023. This level of difficulty actually reflects the profitability of the mining business. During low competition, the network is less profitable for miners.

VOIR éGALEMENT:

This phenomenon is also accompanied by an increase in the hash rate, which measures the total strength of the network in executing transactions and maintaining security. Currently, the Bitcoin network hash rate reaches an all-time high, showing the confidence and confidence of participants in network reliability.

All of these indicators provide optimism for the future of Bitcoin and Ether (ETH). Analysts argue that the intrinsic value of these two assets should not be ruled out by price drops, and there is a tendency to accumulate assets at a time like this.

In addition, the number of Bitcoins held by mining entities has increased slightly since early August, suggesting that industry players still have confidence in the potential growth of cryptocurrencies.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)