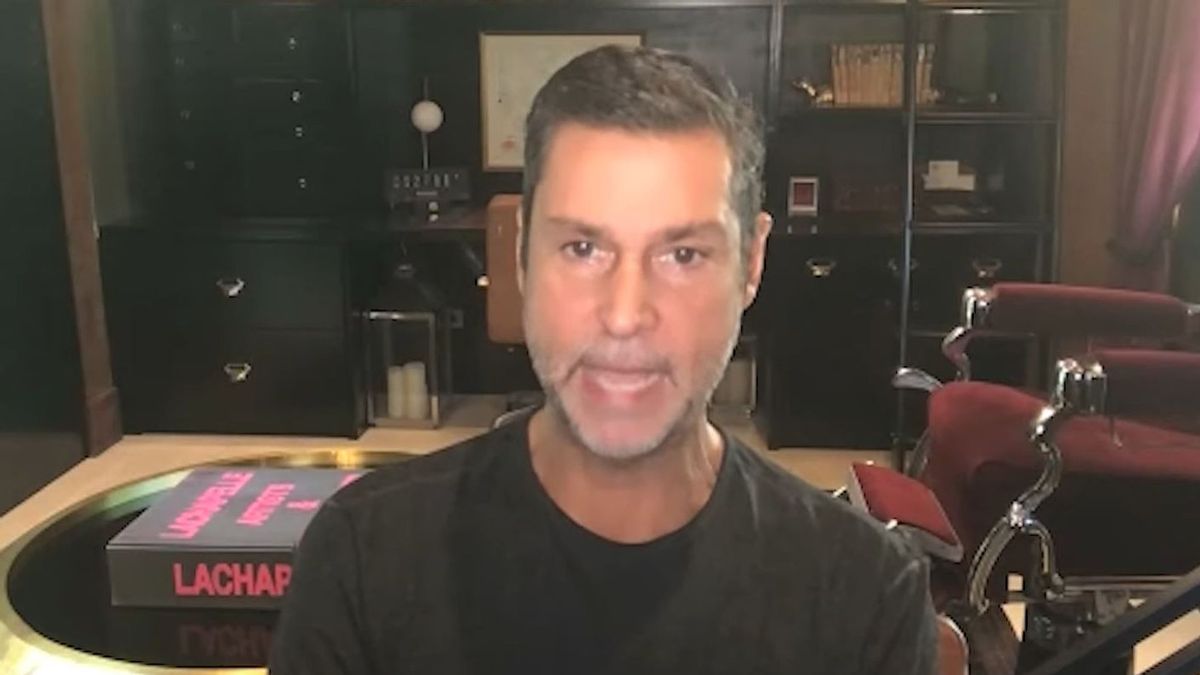

JAKARTA - Macro investor, Raoul Pal, believes that the current “bear” condition of the crypto market will end only after the Fed loosens its hawkish monetary policy by halting interest rate hikes. According to Pal's predictions, it could happen in the next few months.

“The Fed is unlikely to raise interest rates as far and as quickly as one might expect. My guess is they might stop raising interest rates in the summer and that's it," he said in an exclusive interview with Cointelegraph.

Pal sees the combination of high interest rates and fear of an impending recession as the main macro factor causing the current crypto market downturn.

“Retail investors' incomes don't rise as much as prices, so they lose discretionary income. So, people can only spend less dollars on average, can engage less,” he said.

Pal thinks that the market bottom has not been reached and a mass liquidation phase involving crypto and legacy assets is coming soon.

“Crypto could see a liquidation spike at some point if we look at it in equities and in the end it will be the final capitulation of the market,” he said.

At that point, according to Pal, the Fed will loosen its monetary policy, allowing some liquidity to flow into financial markets, thereby triggering the next crypto rally.

"We're going to see a bond rally, a crypto rally, maybe some tech stocks rally," Pal said.

Apart from the macro picture, other factors that could facilitate the next uptick are Bitcoin spot ETF approvals and Ethereum's switch to a proof of stake system, which is expected for Q3.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)