YOGYAKARTA What are the goods subject to customs tax? Before answering this question, you need to know that excise duty' is not a single word or term. Customs is two different terms.

Quoted from the Ministry of Finance's Klc2 page, Customs is a levy imposed on the entry and exit of related goods/commodities that enter and leave the customs area.

Meanwhile, what is meant by excise is the state levy imposed on certain items that have the characteristics or characteristics stipulated in the Excise Law.

As mentioned above, the duty has an understanding of tax levies whose amount is set by the government.

In this regard, there are two types of goods that are subject to duties, namely imported goods and export goods.

State levies on imported goods are called import duties. Meanwhile, the levies imposed on exported goods are called exit duties.

This is stated in Law Number 17 of 2006 concerning Amendments to Law Number 10 of 1995 concerning Customs.

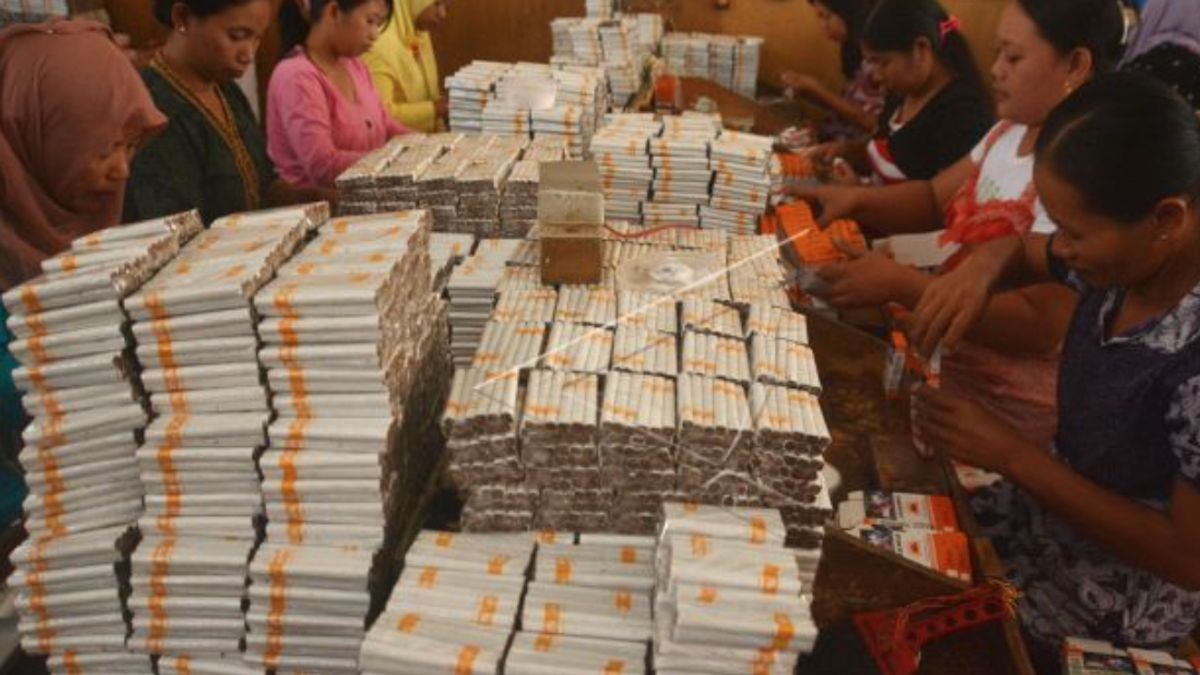

Meanwhile, according to Law Number 39 of 2007 concerning Excise, there are several types of goods subject to excise, including:

A more detailed explanation regarding excisable goods is stated in Law Number 7 of 2021 concerning Harmonization of Tax Regulations.

The law explains the nature and characteristics of goods subject to excise tax. The following are a number of goods subject to excise tax according to Law no. 7/2021:

For additional information, the excise tariff for tobacco products set is 57% (fifty-seven percent) of the Retail Selling Price (HJE) proposed by factory entrepreneurs.

This is information about goods subject to customs tax. Hopefully this article can increase the insight of VOI.ID readers.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)