JAKARTA - Bank DKI as one of the banks that distribute People's Business Credit (KUR), shows its full commitment to successfully channeling the entire 2022 KUR quota provided by the Government, amounting to IDR 1.15 trillion.

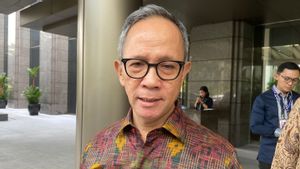

Bank DKI President Director, Fidri Arnaldy said that Bank DKI is fully committed to maximizing KUR distribution as an expansion of access to capital for MSMEs.

"Throughout 2022, Bank DKI has succeeded in distributing a KUR quota of 100 percent to approximately 6,023 MSME and Micro business actors. As one of the KUR channeling banks, Bank DKI is not only committed to increasing access to financing, but empowerment and assistance for MSMEs to continue to grow and develop in supporting national economic growth," said Fidri, in his statement, Friday, January 20.

As mandated by the Government, the distribution of KUR Bank DKI focuses on several sectors, namely people's plantations, people's livestock, people's fisheries, MSME industries, and other businesses that have great market opportunities or superior products in the country.

The government continues to be committed to encouraging increased capital for MSMEs in order to maintain national economic stability amid projected uncertainty in global economic conditions in 2023. Most recently, through the Ministry of Cooperatives and SMEs, it also involved Bank DKI as a distributor, launching the People's Business Credit (KUR) program with a business group or cluster-based scheme, at the State Palace on Monday 19 December 2022.

Also attending the event were Coordinating Minister for Economic Affairs Airlangga Hartarto, Minister for Cooperatives and Small and Medium Enterprises Teten Masduki, Minister of Finance Sri Mulyani, and Minister of National Development Planning/Head of Bappenas Suharso Monoarfa.

In his remarks, the President hoped that with the KUR cluster model, MSME products could be absorbed as much as possible and get certainty in the market.

"We really hope that we can absorb the most goods from existing groups, and obtain market certainty, reduce the risk of business financing credit and from KUR channeling institutions, especially banks," added the President.

For information, the Interest Subsidy Scheme KUR program has been disbursed since 2015 to MSMEs. In the last seven years, the KUR volume has continued to increase in value with the total channeled almost Rp1,300 trillion.

Meanwhile, the realization of KUR for the January 2022 period until December 15, 2022, was IDR 348.47 trillion (93.38 percent of the 2022 target of IDR 373.17 trillion), and was given to around 7.27 million debtors. For KUR Clusters, which have accessed 14,888 clusters with a total MSME number of 1.3 million units, and the realization of distribution (as of December 15, 2022) of IDR 4.8 trillion or 96.7 percent of the total IDR 4.9 trillion.

Bank DKI Corporate Secretary Arie Rinaldi added that apart from the capital side, Bank DKI is also actively developing a market digitization program in DKI Jakarta, especially the Perumda Pasar Jaya management market. Finally, Bank DKI implemented a digitization program at Ciracas Market.

The market digitization program provides a payment ecosystem through the JakOne Abank application, implementation of QRIS, to digitizing payments in other facilities within the market environment which is expected to encourage the implementation of non-cash transactions.

In supporting the MSME sector, Bank DKI also provides JakOne Mobile as a super app with various digital service features that can accommodate various daily financial transaction needs, especially for traders and market visitors, such as payments for various bills, taxes, levies, online shopping, electronic money top ups, Scan by QRIS, to charity.

Arie further added that market digitization is expected to bring benefits, namely the expansion of financial inclusion in DKI Jakarta through the implementation of non-cash transactions.

"Bank DKI is currently also developing the Digital Lending application as a solution in providing access to capital for business actors which is certainly good for accelerating economic growth, especially in DKI Jakarta," concluded Arie.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)