JAKARTA - Bank Indonesia (BI) continues to relax the provisions of down payment (DP) on loans or financing motorized and property vehicles to at least zero percent. This decision is effective from January 1 to December 31, 2023.

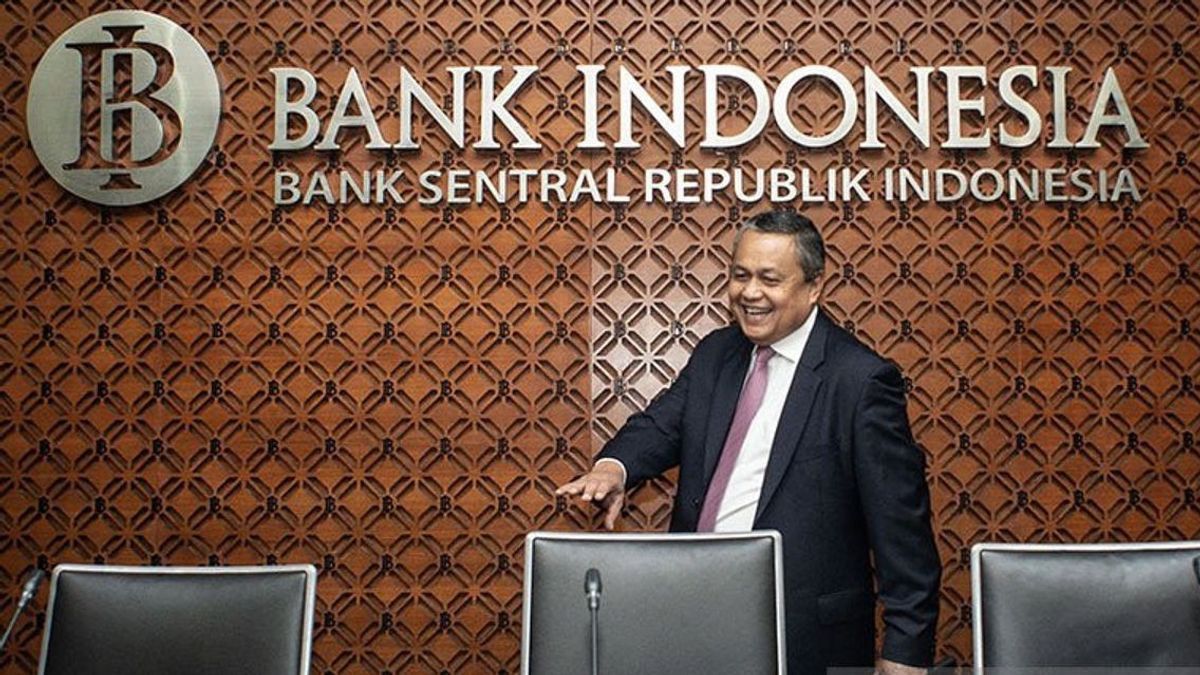

"This step was taken as a continuation of the implementation of accommodative macroprudential policies to encourage lending or bank financing to the business world," said BI Governor Perry Warjiyo, quoted by Antara, Thursday, October 20.

He explained that the zero percent DP policy was given to all types of new motorized vehicles to encourage credit growth in the automotive sector while still paying attention to the principles of prudence and risk management.

Meanwhile, for property, BI continues to loosen the loan to value/financing to value (LTV/FTV) ratio for credit or property financing to a maximum of 100 percent for all types of properties, namely landed houses, flats, and shop houses.

This easing will cause banks that meet certain credit or bad financing ratio criteria or non-performing loans/non-performing financing (NPL/NPF) can provide down payment for home ownership loans (KPR) to at least zero percent to the public.

Through this policy, credit growth in the property sector is expected to increase while still paying attention to the principles of prudence and risk management.

Perry Warjiyo continued that the implementation of other accommodative macroprudential policies was also carried out by maintaining the countercyclical capital buffer (CyB) ratio of zero percent and the macroprudential intermediation ratio (RIM) in the range of 84 percent to 94 percent.

Furthermore, the ratio of macroprudential liquidity (PLM) buffers is also maintained at 6 percent with a recap flexibility of 6 percent and a Sharia PLM ratio of 4.5 percent with a repo flexibility of 4.5 percent.

He emphasized that the policy synergy between BI and the government's fiscal policy and with the Financial System Stability Committee (KSSK) continues to be strengthened in order to maintain macroeconomic and financial system stability, as well as encourage credit or financing to the business world in priority sectors to support economic growth, exports, and economic and financial inclusion.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)