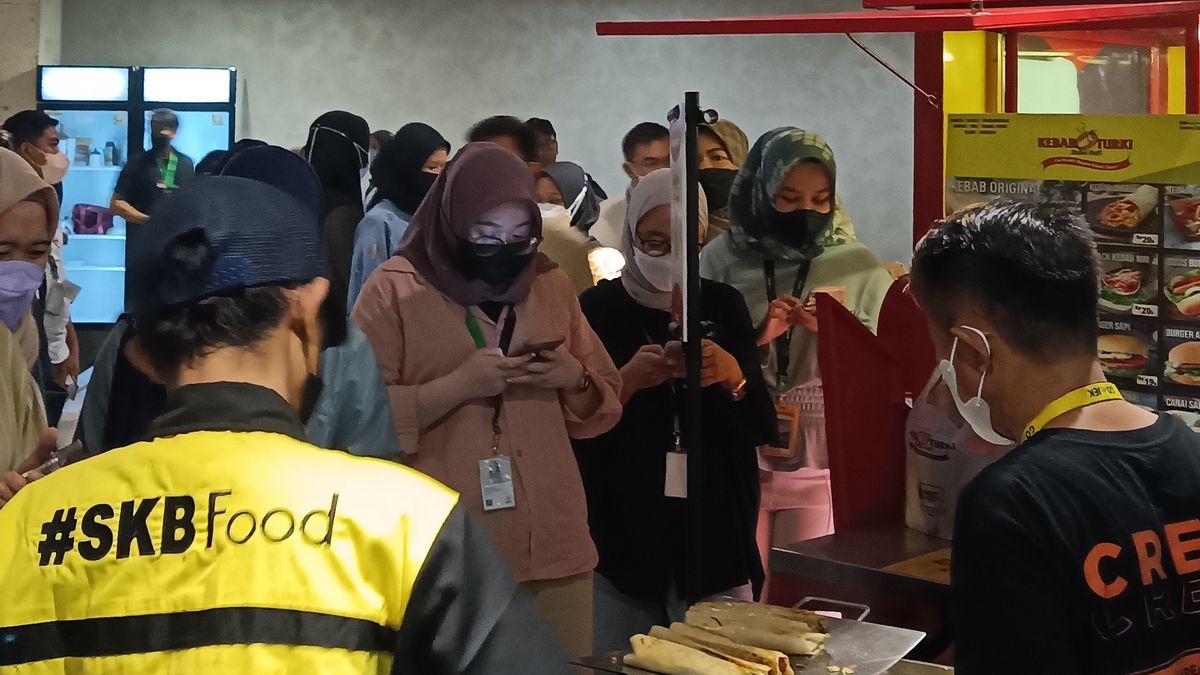

JAKARTA - The high interest of investors in PT Sari Kreasi Boga Tbk (SKB Food) shares with the code RAFI is reflected in the results of the initial public offering which took place on 1-3 August 2022. The order value was recorded at Rp1.57 trillion due to oversubscribed as much as Rp. 75.75 times.

Investment Banking Division of PT Investindo Nusantara Sekuritas Zharfan Dhaifullah as the Implementing Underwriter for the Initial Public Offering (IPO) of SKB Food explained, the number of share subscriptions in the initial public offering of RAFI shares with an electronic public offering system is quite high. There were 21,000 subscribers with a total subscription of 12.44 billion shares.

For centralized allotment (pooling) the number of subscriptions reached 11.65 billion shares, resulting in nearly 82 oversubscribed shares. In total, 13 times oversubscribed occurred during the public offering.

"Incoming orders were 120.243 million lots for pooling or almost 82 times oversubscribed (81.90 times) from the pooling offered," he said in a written statement, Thursday, August 4.

Meanwhile, orders for the fixed allotment (Fixed Allotment) were recorded at 7.893 million lots, bringing the total orders to 128.136 million lots for RAFI shares or reflecting 1,351.53 percent, which is equivalent to more than Rp1.57 trillion of the total shares offered by SKB Food during the IPO process. this.

President Commissioner of SKB Food Jadug Trimulyo Ainul Amri also hopes that the high interest of investors in RAFI's share offering will be a motivation for Indonesian MSME business actors to continue to develop, implement good governance principles, and continue to be adaptive and innovative in the face of high dynamics that occur today.

"Hopefully the high market appreciation for RAFI's share offering, which we know started from a cart on the pavement floor until it can be on the floor at the stock exchange, will also be a reflection of the strength and pride of Indonesian MSMEs that are able to survive and quickly rise in the midst of a pandemic. We believe that there are many other great Indonesian MSMEs that have been involved in supporting the economy of our country so that they are able to escape from all the difficulties of the global economy," said the 26-year-old Komut.

North Director of SKB Food, Eko Pujianto, added that the high interest from investors is proof that MSMEs can go up in class. He said that every effort made in earnest would not betray the results. Eko said that SKB Food's journey to the stock exchange was quite long and went through many phases.

“Initially, SKB Food was an MSME, then in 2017 we improved internally so that we could implement a corporate culture. During the pandemic, we were able to survive and grow even more, until now we can do an IPO with the hope that it will grow even better,” said the Ponorogo-born CEO who became the youngest CEO in Indonesia at the IPO.

As is known, SKB Food offers a maximum of 9.4 million lots or 948,090,000 common shares on behalf of which are all new shares issued from the portfolio, with a nominal value of Rp. 15 per share. This amount represents a maximum of 30.31 percent of the issued and paid-up capital of the Company after the initial public offering of shares and an initial price of Rp126 per share is formed.

RAFI shares will be officially listed on the Indonesia Stock Exchange (IDX) on Friday (August 5, 2022) and the plan will be offline at the Opening Bell Ceremony at the IDX building, Jakarta.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)