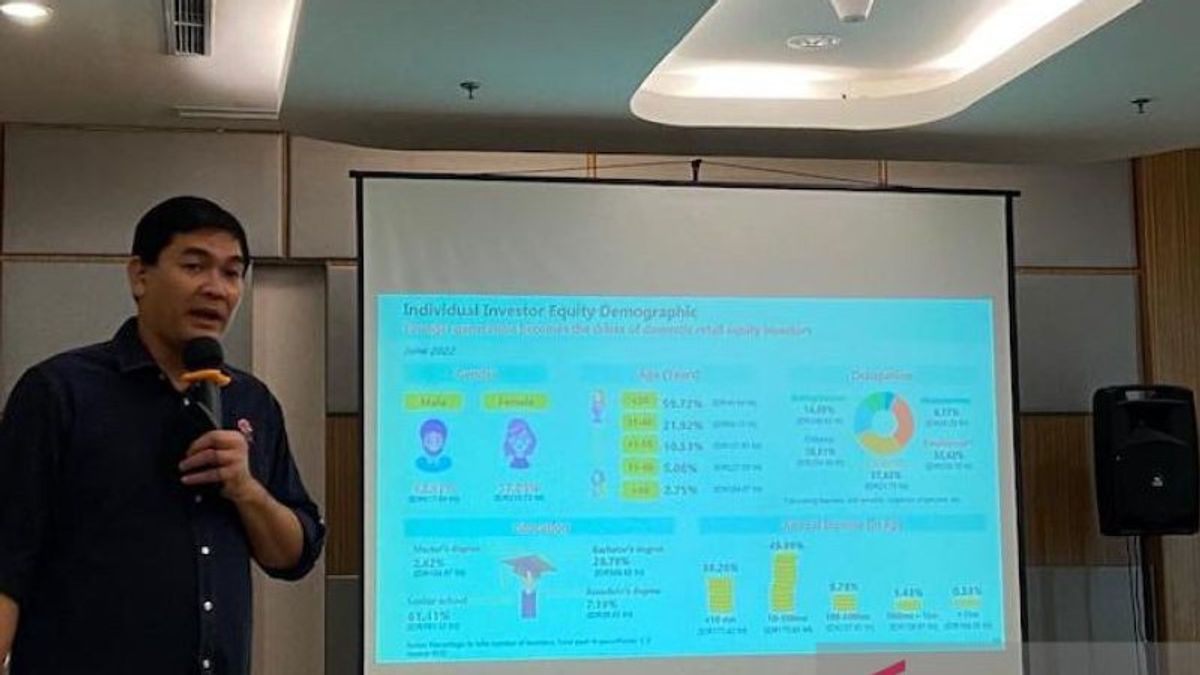

PALEMBANG - Generation Z under 30 years old dominates the current capital market investors with a percentage reaching 59.72 percent.

Head of the South Sumatra Indonesia Stock Exchange Representative Office, Hari Mulyono, said that the previous dominance was among millennials, but after the COVID-19 pandemic it shifted to Generation Z (born 1995-2010).

"From this phenomenon, it means that literacy will be more intensively given to generation Z because currently there are also many illegal investments," he said in Palembang, Antara, Sunday, July 31.

Based on IDX data, it is stated that the second dominance for capital market investors is millennials aged 31-40 years (21.92 percent), 41-50 years old (10.53 percent), 51-60 years (5.08 percent) and more than 60 years old (2.75 percent).

He said maximizing this potential, IDX already has a 3P education strategy (Understand, Own and Monitor) especially to provide education related to the capital market to millennials and Generation Z. Before going to the stock exchange, prospective investors should understand the capital market.

Based on the results of IDX research, there are several beginner mistakes (12-18 months of being an investor) including, using sources of funds from debt, making decisions without careful consideration or just joining in, swallowing recommendations raw and experiencing panic when stock prices down.

Then, 'young' investors do not have plans, do not want to upgrade themselves and do not diversify their investments.

"These mistakes occur because they don't really understand what the capital market is, which is not actually buying securities but buying future businesses," he said.

If you already understand about the capital market, potential investors are encouraged to enter the phase of owning a capital market product. Understanding in this case is understanding investment objectives, risks and returns as well as digital applications.

"Furthermore, at the stage of having 'Have' by contacting securities that are members of the IDX, and the last one is 'Monitoring'," he said.

This monitoring can take the form of regular checks to ensure whether the investment objectives have been achieved.

"If it can be achieved before the target, it is called a bonus, but it should be understood that the capital market is dynamic, that is, there are ups and downs," he said.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)