JAKARTA - The Association of State Banks (Himbara) revealed that the direction for lowering credit interest rates from the government is not the main aspect in boosting the banking intermediary function.

Chairman Himbara Sunarso explained the demand for credit could increase if household consumption and people's purchasing power increased.

"Therefore, it is very appropriate that in this pandemic condition, the government issued various direct stimuli to the public," he said in an official statement received by VOI, Thursday, January 7.

Sunarso added that the cut in BI's benchmark interest rate was followed by a decrease in loan interest rates, but the lower loan interest rate was not followed by an increase in loan growth.

"We must be wise to look at ways to increase credit growth, because lower interest rates do not always control credit growth," he added.

For example, the decrease in the people's business credit interest rate (KUR) also did not encourage an increase in the aggregate of bank loans, in 2015 and 2016. In fact, when the KUR interest rate decreased significantly, loan growth actually decreased to below 10 percent.

"So the key to credit demand lies in household consumption and people's purchasing power," said Sunarso.

On the same occasion, President Director of Bank Mandiri Darmawan Junaidi said that the current Himbara Cost of Funds (CoF) cannot be low because the funding portfolio still has a relatively large portion of expensive funds.

In the future, he continued, there needs to be a diversification of the types of funding that Himbara does, especially the types of low-cost savings to reduce the level of cost of funds.

"If seen, the ratio of cheap funds (CASA) in a national private bank is already above 70 percent, while in us it may be around 65 percent to close to 70 percent. In the future, we have to see how Himbara grows its CASA ratio, ”said Darmawan.

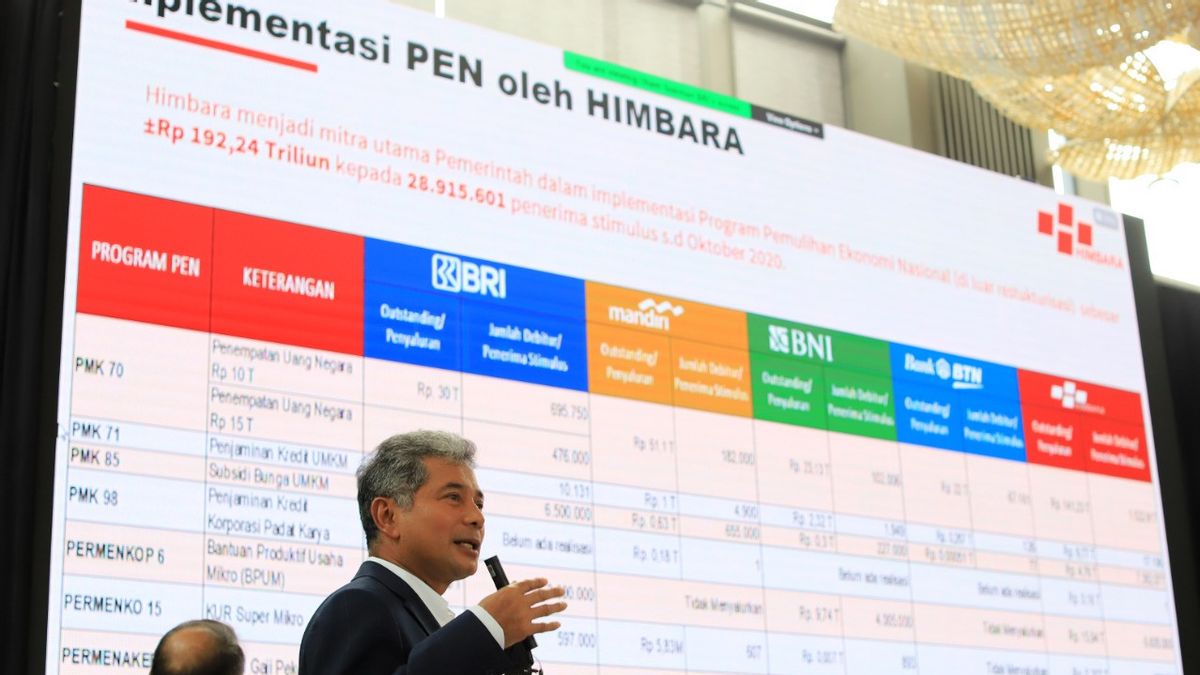

For information, currently the State Bank Association dominates the market share of national commercial banks in terms of assets, loans and deposits. Recorded market share for the asset side of 41.59 percent, loans 43.54 percent and deposits 43.46 percent. Himbara itself consists of BRI, Bank Mandiri, BNI and BTN.

Himbara also runs efforts to empower micro, small and medium enterprises (MSMEs) as well as the distribution of social assistance initiated by the government.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)