JAKARTA - PT Asuransi Jiwa Manulife Indonesia recorded significant growth throughout 2021 by disbursing customer claims of up to Rp. 8.9 trillion.

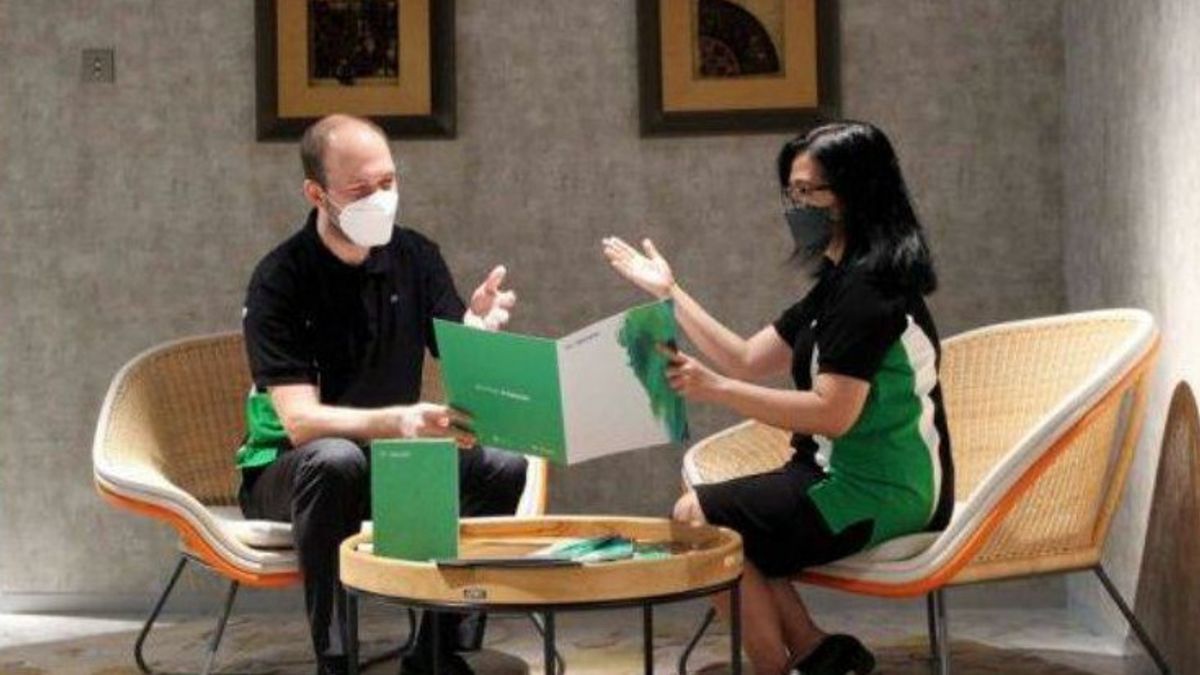

Manulife Indonesia President Director and CEO Ryan Charland in a statement in Jakarta, Monday 23 May said, throughout 2021 Manulife Indonesia achieved a net insurance premium income of IDR 12.1 trillion, an increase of 42 percent compared to 2020. The significant growth was driven by an increase in premium income in the same year.

In addition, the performance of new business premiums in 2021 will grow double digits by 35 percent from the previous Rp. 5.6 trillion to Rp. 7.5 trillion (based on the Annualized Premium Equivalent/APE).

"Apart from this strong business growth, we are always committed to helping people achieve their financial goals and make their lives better. 2021 will be a challenging year, but our commitment to our customers can still be seen from the results of claim payments throughout the year amounting to IDR 8.9 trillion or IDR 25 billion every day," Ryan said, quoted by Antara.

The positive premium performance was also followed by the growth of Manulife Indonesia's assets. Until the end of 2021, Manulife's total assets under management grew 21 percent on an annual basis from IDR 86 trillion to IDR 104 trillion. This indicates improving financial market conditions after the pressure of the COVID-19 pandemic since 2020.

Ryan also said that another indicator of strength is that Manulife has a technical reserve of IDR 41.6 trillion until the end of 2021, which also confirms the company's determination to ensure long-term financial protection for all of its customers.

In addition, Manulife continues to maintain a strong capital position to support its overall business operations with a risk-based capital (RBC) ratio of 825 percent for conventional businesses and an RBC tabarru fund for sharia units in December 2021 of 609 percent.

Meanwhile, Manulife Aset Manajemen Indonesia (MAMI) has also managed to maintain its position as one of the largest investment management companies in Indonesia.

MAMI CEO and President Director Afifa said that throughout 2021, MAMI's total managed funds grew 16.7 percent to Rp113.4 trillion and mutual fund managed funds increased 27.4 percent to Rp62.9 trillion at the end of 2021.

"We are very grateful and grateful for the trust of investors, institutions and individuals, as well as the support of MAMI's distribution partners. This support and trust has allowed us to successfully maintain MAMI's position in the first rank of the list of investment manager companies with the largest mutual fund managed funds in Indonesia," he said.

Both Manulife Indonesia and MAMI are optimistic that 2022's performance will be better considering the condition of the Indonesian economy is starting to improve as the pandemic subsides.

Manulife is committed to the growing need for long-term insurance protection given the low penetration and increasing public understanding of the importance of being protected by insurance.

Insurance observer Irvan Rahardjo also estimates that in 2022 the insurance industry will grow and be better than before the pandemic.

"I think it can, because the economy has grown 5.01 percent in the first quarter of 2022, and it is expected to continue to increase," he said.

The Indonesian Life Insurance Association (AAJI) noted that the life insurance industry posted a total revenue of IDR 241.17 trillion throughout 2021 or grew 11.9 percent year-on-year (yoy). The growth was supported by the acquisition of premiums which reached Rp202.93 trillion, up 8.2 percent yoy. This premium income even exceeds the premium earned in 2019 or the period before the COVID-19 pandemic.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)