JAKARTA - The Regional Representative Council (DPD RI) must make a total correction by providing input to President Joko Widodo regarding the amount of state losses due to the provision of Bank Indonesia Liquidity Assistance (BLBI) facilities. One of the important corrections is related to the large number of state losses that the BLBI Hunting Task Force must pursue.

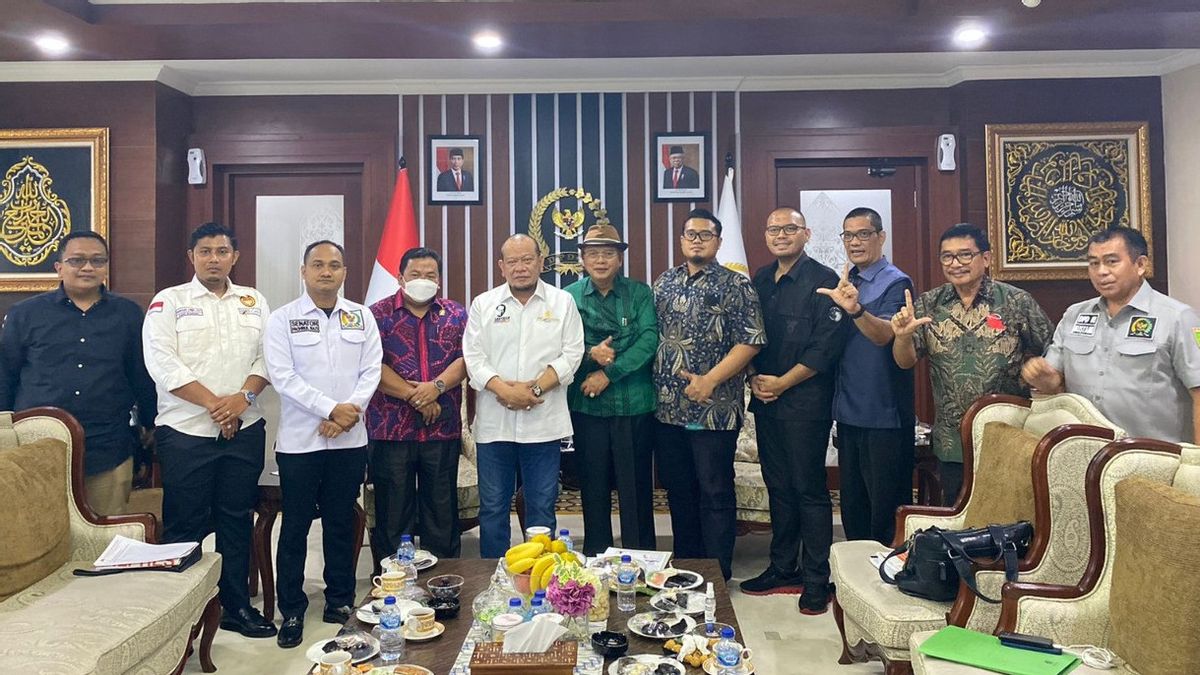

"It is very disproportionate if the hunting team or the BLBI Task Force only pursued Rp. 110 trillion rather than BI obligors or conglomerates who enjoyed BLBI facilities since 1997-1998," said Chairman of the State Economic and Financial Research Institute (LPEKN) Sasmito Hadinegoro in front of the Chairman of the DPD RI AA La Nyalla Mahmud Mattalitti, Chairperson of Committee I DPD RI Fachrul Razi, Chairperson of Committee III DPD RI Sylviana Murni and Chairperson of Committee IV DPD RI, H. Sukiryanto at the DPD RI Building, last Tuesday 23 November.

Sasmito's presence in the DPD RI building was at the request of the DPD RI regarding the completion of the BLBI scandal that had cost the country decades. According to Sasmito in his written statement, the case of misuse of BLBI funds since BI distributed them to 48 banks in Indonesia at that time was valued at Rp. 144.5 trillion. However, after being audited by the BPK during the BJ Habibie administration, the real BLBI funds amounted to Rp210 trillion.

The results of this BPK audit concluded that the use of BLBI funds had been misappropriated and caused state losses of Rp. 138.4 trillion.

"It is reasonable to suspect that the provision of BLBI funds that cannot be accounted for indicates corruption, which should have been resolved by law enforcement in accordance with the Corruption Act," said this observer of the State Finance Economy.

He said that this pattern of resolving the BLBI scandal prioritizes its handling based on the amount of BLBI facilities received by BLBI obligor bankers who took advantage of the monetary crisis situation that occurred in 1997-1998.

The reason is, due to the misuse of BLBI funds, the government was forced to follow the IMF's directives by taking over all bankrupt banks. But at that time, the government did not have enough fresh funds to meet the requirements for recapitalization.

The purpose of the recapitalized banks is to meet the capital adequacy requirements of 8 percent and (CAR = capital adequacy ratio) in accordance with the provisions of the Bank for International Settlement (BIS) domiciled in Bazel, Switzerland. Because they do not have fresh money, the government issues Government Securities (SUN).

This SUN is specifically for recapitalization which is called “government recapitalization bonds” with a value of Rp430 trillion.

Due to the form of bonds, the government has an obligation to pay interest, with a total interest payment of IDR 600 trillion.

As a result of the misuse of the BLBI facility, the government's total burden was IDR 1,030 trillion.

This figure should be expected to increase if the repayment is delayed or the government does not make new policy breakthroughs which can be called as part of the “state financial revolution”. Moreover, during the 10 years of Susilo Bambang Yudhoyono's administration, the mega scandal over the misuse of the BLBI facility was not taken seriously.

Therefore, he hopes that in the era of President Jokowi's administration, he must show concrete steps in law enforcement in the BLBI case.

"And it should be supported by the DPD RI in the shortest possible time," he explained.

Sasmito emphasized that there were two important things regarding the types of state losses that occurred, namely:

1. Companies or assets that are handed over by obligors to the government as debt payments for the BLBI facility they receive, whose sales proceeds are much smaller than the value of the debt, especially in dealing with this situation. The National Police and the Attorney General's Office must investigate two major cases, namely the BCA bank scandal and the BDNI scandal.

2. Losses in the form of SUN, with the issuance of recapitulation bonds of the former BLBI which in the 10-year period of SBY's presidency only until 2014, the interest payments on government recapitulation bonds were estimated to be Rp. 960 trillion.

"Based on the confession of the former President Director of Bank Mandiri, the late ECW Neloe to me directly, the recapitulation bonds required by Bank Mandiri were actually only Rp. 100 trillion. Agus Martowardoyo has a value of IDR 176 trillion," he explained.

From this figure, there has been a mark up of around Rp. 76 trillion.

This means that the government provides interest subsidies on ex-BLBI recap bonds, which are an average of 10 percent per year, worth Rp.7.6 trillion, which is supposed to be fictitious.

"The same thing should be suspected for other banks receiving government recapitulation bonds," he concluded.

The English, Chinese, Japanese, Arabic, and French versions are automatically generated by the AI. So there may still be inaccuracies in translating, please always see Indonesian as our main language. (system supported by DigitalSiber.id)